Q4 2024 Earnings: Americold Realty Trust (COLD)

A quick update on our previous post about Americold Realty Trust (COLD).

Americold Realty Trust press release (COLD):

Q4 AFFO of $0.37 beats by $0.08.

Revenue of $666.4M (-1.9% Y/Y) misses by $17.63M.

Core EBITDA of $155.6 million, decreased $4.7 million, or 2.9% from $160.3 million in Q4 2023.

Core EBITDA margin of 23.3%, decreased 25 basis points from 23.6% in Q4 2023.

Net loss of $36.4 million, or $0.13 loss per diluted common share, an 84.0% increase from an $0.80 net loss per diluted common share in Q4 2023. Global Warehouse segment same store revenues decreased 0.5% on an actual basis and increased 0.6% on a constant currency basis as compared to Q4 2023.

Global Warehouse same store services margin increased to 13.2% from 6.3% in Q4 2023.

Global Warehouse segment same store NOI increased 4.9%, or 5.9% on a constant currency basis as compared to Q4 2023.

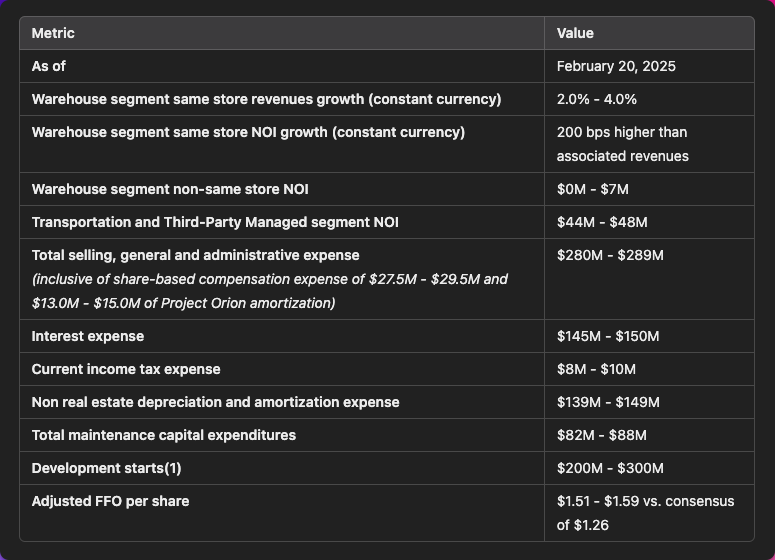

2025 Outlook

The table below includes the details of our annual guidance. The Company’s guidance is provided for informational purposes based on current plans and assumptions and is subject to change.

The ranges for these metrics do not include the impact of acquisitions, dispositions, or capital markets activity beyond that which has been previously announced.

The Good

- 16% growth in Adjusted FFO

- Huge improvement in profits but the company is still losing money.

- Improved services margin 11.1% previously 5.6%. We want to see some more improvement here, the right steps in the right direction.

- Same store service margin is probably the best indicator that improves of these earnings.

The Bad

- Physical occupancy rate falls 6.9% Economical occupancy falls 5.3%

- 10% higher power costs.

- We see improvements in Q4, and expect some more in 2025.

- Realistic revenue and NOI growth, as we expect revenue to climb faster next quarter.

- New developments will bring economic impact in Q2 2026

Get access to all the content and sheets for just $19/month